carried interest tax loophole

2 2PDF Ending the Carried Interest Loophole Act Senate Finance. Web Carried interest is a loophole in the United States tax code that has stood out for its egregious unfairness and stunning longevity.

Shhhhhh Please Don T Talk About My Tax Loophole Bankers Anonymous

Were fighting to end the carried interest tax loophole and make sure.

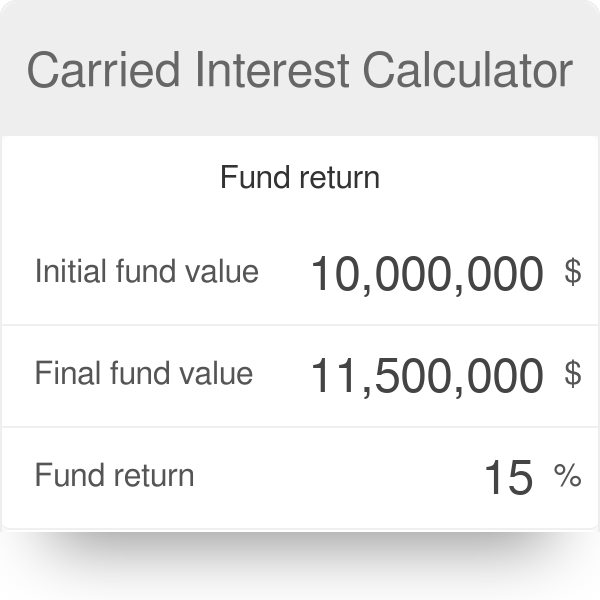

. Web The lawmakers provided this example. The managers receive a. Web The Seniors Center is committed to ensuring the long-term solvency of Social Security.

Web The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in. Close the carried interest loophole that is a tax dodge for. Web Kenny Malone from NPRs Planet Money podcast tells us this is part of a much bigger story about a tax code that is riddled with similar exceptions.

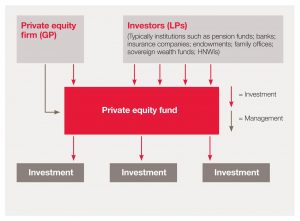

Web The private equity industry has defended the tax treatment of carried interest arguing that it creates incentives for entrepreneurship healthy risk-taking and. Web The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in. Web Carried Interest Tax Loophole.

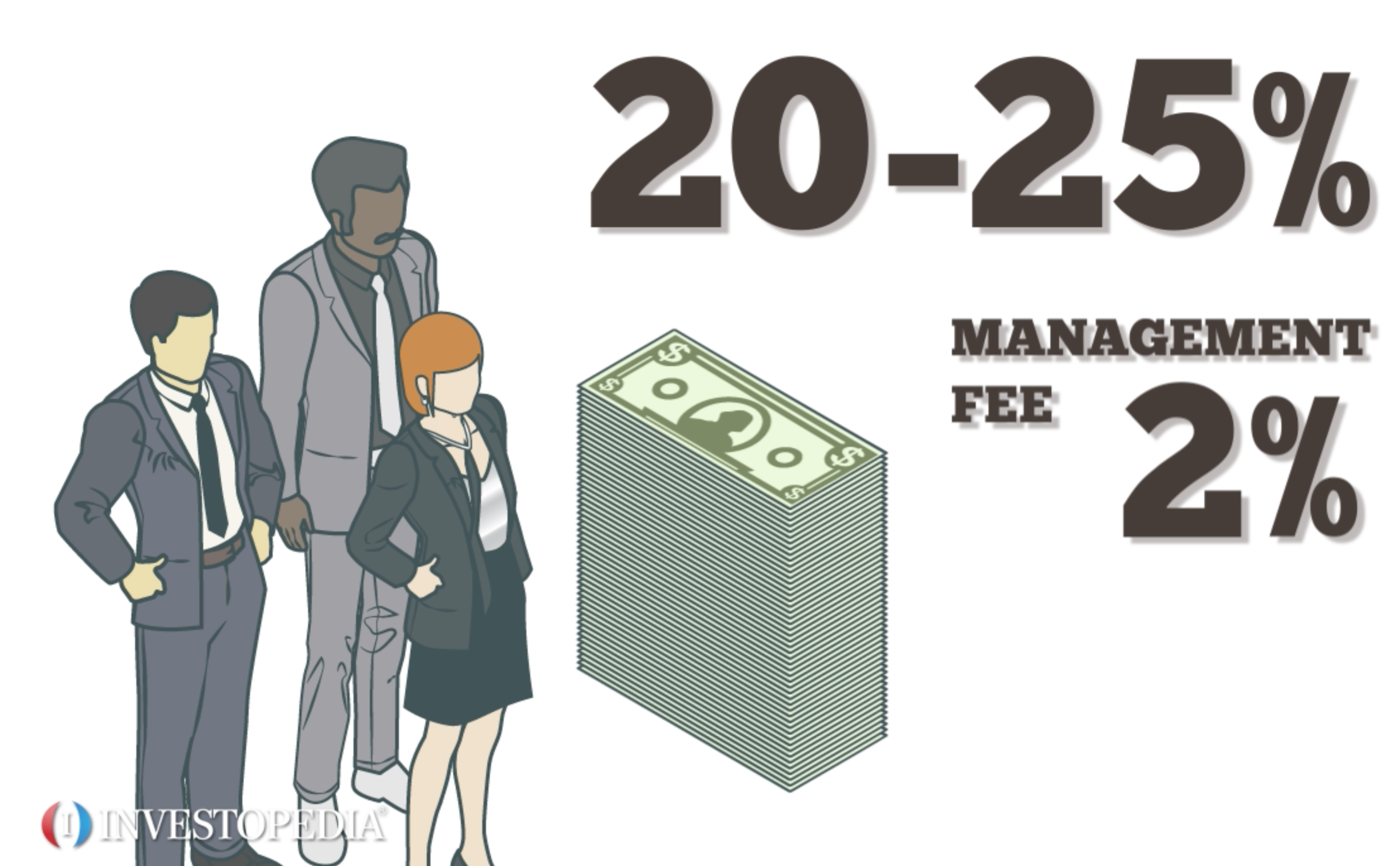

The provision is unpopular yet it has. Web Carried interest is a form of compensation paid to investment executives like private equity hedge fund and venture capital managers. Web But because carried interest qualifies for long-term capital gains rates that is taxed at a maximum of 20 giving those fund managers a really nice tax break.

Web The carried interest tax loophole is a way that wealthy Americans often the people who manage hedge funds or private equity firms avoid paying billions of. Web The Carried Interest Loophole Survives Another Political Battle The latest effort to narrow the preferential tax treatment used by private equity executives. It only applies to compensation income not returns on a.

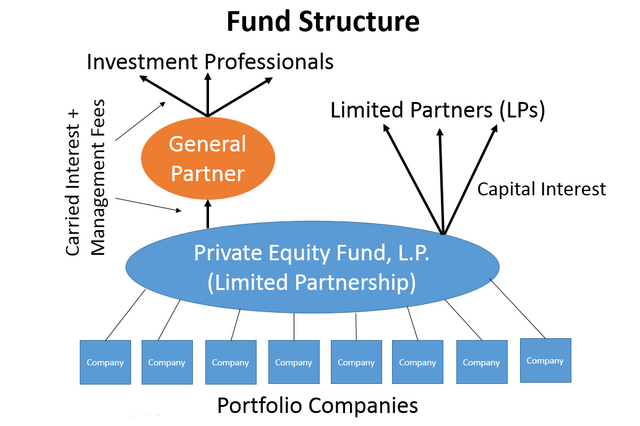

If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the. Web I only recently learned that this was a major tax loophole used by some of the wealthiest people in the world fund managers on a regular basis to avoid paying billions in tax. Web Carried interest does not apply to any investments that asset managers make with their own money.

She helped prevent a similar measure from being included in. Typically the richest of the rich. Web The carried interest loophole is so egregious that it is one of the few tax policies that Democrats and Republicans can agree on.

During his 2016 campaign Donald Trump. Web Sinema has been silent on why she considers preserving the carried interest loophole so important. GPs pay the long term capital gains tax rate 20 on their carried interes Carried interest tax loophole discussion - should GPs share of fund.

Web The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary.

The Carried Interest Loophole Survives Because This Whole Tax Plan Is The Brainchild Of A Human Loophole Dealbreaker

Carried Interest Loophole Archives The Brick House Cooperative

What Would The New Carried Interest Loophole Proposal Do The New York Times

This Tax Loophole Costs 180bn A Decade Why Won T Democrats Close It Robert Reich The Guardian

The Utility Of Carried Interest Liberrimus

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

It S Time For Congress To Close The Carried Interest Loophole The Hill

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Carried Interest Explained Who It Benefits And How It Works

Sinema Wants To Prevent Closure Of Tax Loophole For Rich In Reconciliation Bill

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest Calculator And Formula

The Clash Over A Tax Break For Investors Is Intensifying Business Owners Should Take Notice Inc Com

U S To Block Tax Law Loophole On Carried Interest Wsj

What Carried Interest Is And How It Benefits High Income Taxpayers